Introduction

One of the most common struggles traders face with Apex Trader Funding is understanding and managing the trailing intraday drawdown. It’s a rule that catches many new traders off guard, often causing them to blow accounts before they even get a chance to withdraw profits. In this blog, we’ll break down exactly how the trailing drawdown works, why it can be tricky, and the strategies you can use to master it.

What is the Apex Trailing Intraday Drawdown?

The trailing drawdown is a dynamic threshold that follows your account balance as it moves up in profit. Unlike a static drawdown (which stays fixed once set), the trailing version shifts based on your peak unrealized profits.

Here’s the key idea:

If you’re in a trade and your account balance spikes up, the drawdown threshold will move up with it.

If you don’t close the trade at that peak and the market pulls back, your drawdown is still calculated from the highest unrealized balance, not where you close.

For example, with a $50K Apex account:

Starting balance = $50,000

Trailing drawdown allowance = $2,500 (so you can’t go below $47,500).

If your balance peaks at $50,610 during a trade but you close at $49,500, your new threshold is based on $50,610 — not $49,500. That means you just lost $1,110 worth of cushion simply because you didn’t lock in profits at the peak.

- This means only $1,390 of drawdown remains

When the Drawdown Stops Trailing

The good news is that the trailing drawdown doesn’t last forever. Once your balance reaches a certain point, the trailing function locks and becomes static. For example:

On a $50K account, once your balance passes $52,500, the drawdown stops trailing and is fixed at $50,100.

That means as long as you don’t drop below $50,100, you’re safe from further trailing adjustments.

This is why many experienced traders focus on scalping aggressively until the trailing stops moving.

How to Avoid Losing Drawdown Cushion

The biggest mistake traders make is holding trades too long and giving back unrealized profits. To prevent this:

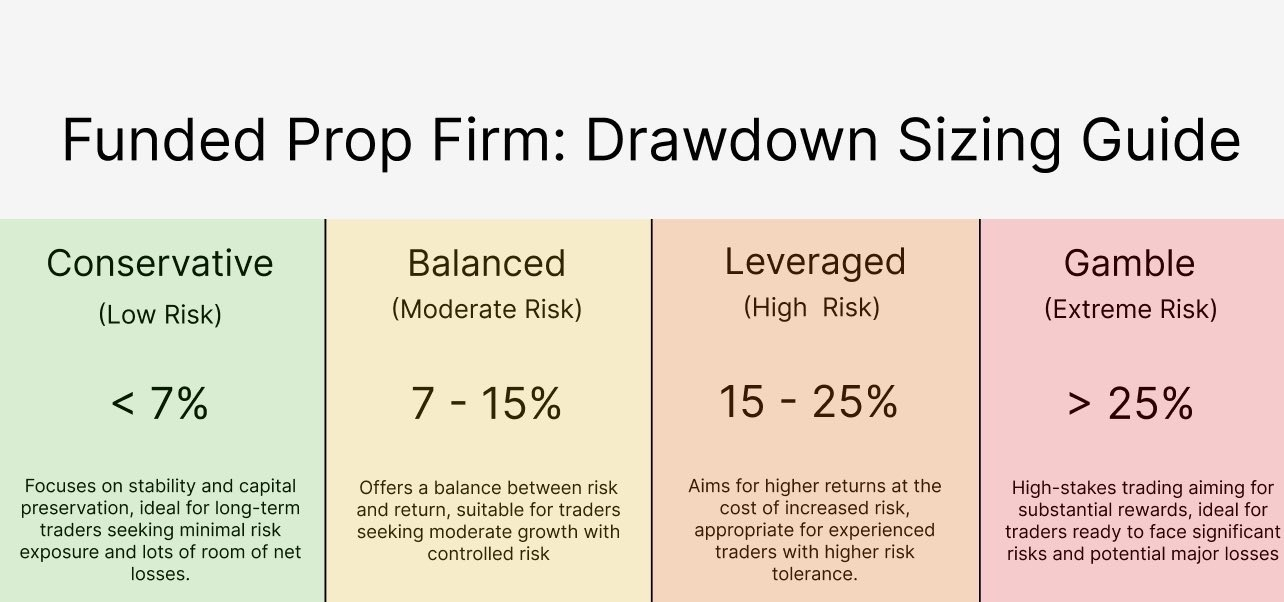

Size down if you’re new to Apex. Only risk 7–15% of your drawdown per trade. On a $50K account, that means $175–$375 risk per trade.

Target 1:2 risk-to-reward ratios. Going for massive home runs often means giving back profit to drawdown.

Scalp base hits early on. Focus on quick profits until the trailing stops moving. Once you’re in the clear, you can let trades run longer.

Advanced Approach: Ripping the Band-Aid Off

For experienced traders, one strategy is to go in with heavy size on A+ setups early. The goal here is to quickly push the account above the threshold where the trailing drawdown stops trailing. Once you’re past that, trading becomes much more comfortable since the drawdown is static.

Important note: this should only be done with setups you have high confidence in — otherwise you risk blowing the account before it even stabilizes.

Tracking the Drawdown in Real Time

You don’t have to guess where your drawdown sits. In NinjaTrader:

Right-click in the control center.

Toggle on “Trailing Max Drawdown.”

This will display your live drawdown status so you can monitor it trade by trade.

You can also track it directly in your Apex account dashboard under “Trailing Max Drawdown.”

Final Thoughts

The Apex trailing intraday drawdown is one of the toughest hurdles for traders transitioning into prop trading. The key to beating it comes down to discipline:

Take profits at logical levels.

Avoid giving back unrealized gains.

Focus on base hits or go heavy on A+ setups — but only when the odds are in your favor.

Once the trailing drawdown is out of the way, trading feels much freer and smoother. Don’t overthink it — just respect the rule, monitor it closely, and focus on trading high-quality setups.