Introduction

Today, I want to walk you through the NASDAQ trade I took, breaking down everything from preparation, analysis, and execution to the final P&L. The goal here isn’t just to recap the trade but to show you the reasoning behind it, so you can see how I approach setups, key levels, and timing.

Pre-Market Preparation

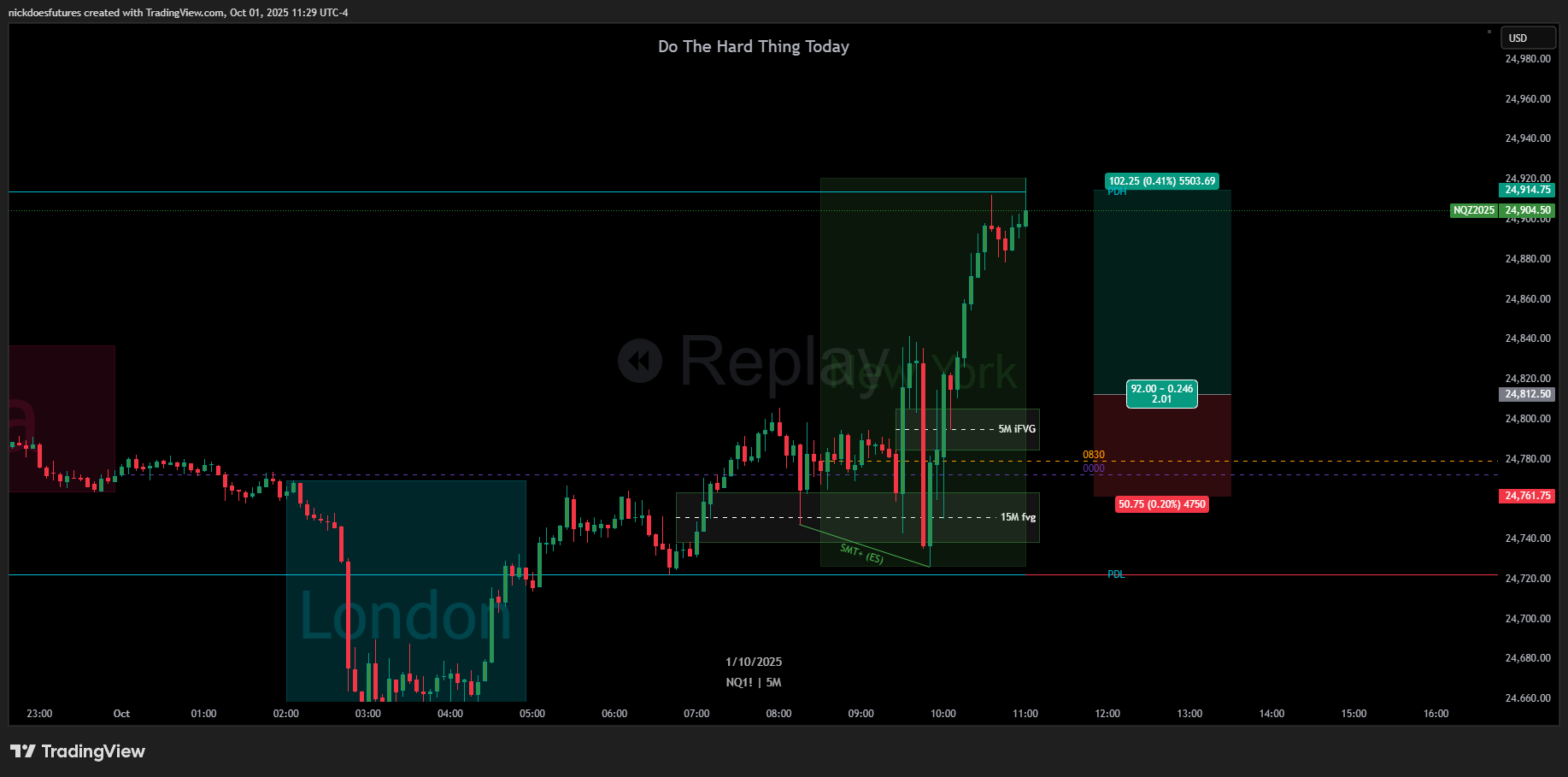

Going into the session, I had my eyes on a few important levels:

Previous Day High (PDH): A strong liquidity pool and natural target when price action is bullish.

Asia Session Highs: Another short-term liquidity point that aligned with my bullish bias.

4-Hour Low: This acted as a swing low and had already been run during the London session, so I wanted to see how New York would react.

The higher-timeframe bias was bullish, so my focus was on setups that could run liquidity toward the PDH.

Dropping Down to Lower Timeframes

On the 15-minute chart, I saw a fair value gap (FVG) forming near the Asia highs. Price had already tapped into this gap a few times, so I wanted confirmation of a move away from it before committing.

I also noted the scheduled 10:00 a.m. news release, which meant I wasn’t going to jump in early. Instead, I waited for the market to show its hand after the 9:45 candle.

Execution Details

Once 10:00 a.m. hit, we got a solid displacement move and a close above the 5-minute FVG. That was my green light.

Entry: Limit order placed inside the FVG with stops tucked under a 5-minute order block.

Target: First Asia highs, then previous day high.

Re-entry: After the retest around 10:15, I added back into the trade.

Price pulled back aggressively at one point, but I stuck to my plan and held through. Eventually, it ran straight into my PDH target around 11:00 a.m.

Trade Outcome

Accounts Traded: 9 Apex 150s

P&L: Roughly $1,300 per account — comfortably above buffer, so payouts are coming soon.

Takeaway: This was the only trade I’ve taken this week. NFP weeks are usually slow and choppy leading up to the release, so I’m selective. Friday will be more promising with NFP volatility in play.

Key Lessons from This Trade

Always align with higher-timeframe bias before looking for entries.

Key liquidity levels like PDH and Asia highs provide reliable targets.

Waiting for news releases can save you from getting chopped up in pre-news volatility.

Don’t panic when price retraces hard — if your plan and levels are valid, trust the setup.

Closing Thoughts

This was a textbook execution of patience, discipline, and trading with a clear bias. Only one solid trade was needed to secure a great day across multiple accounts. Tomorrow I’ll likely stay flat, but I’ll be back Friday to see what NFP brings.